Even after 150 years, The Hongkong and Shanghai Banking Corporation Limited (HSBC) continues to deliver excellent products, services and innovations for its clients in the Philippines. More importantly, it has consistently proven itself as an invaluable partner, not just for personal and business banking needs, but even for nation-building.

By EDWIN P. GALVEZ

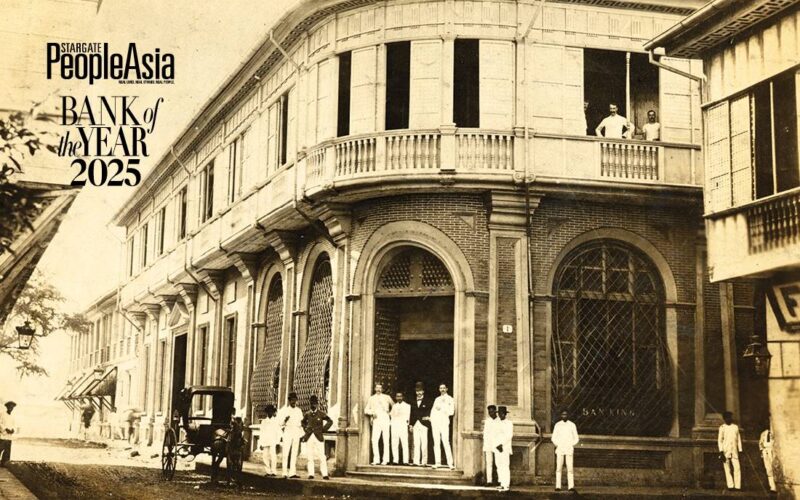

HSBC opened its doors in Binondo, Manila in 1875, just as pioneering foreign investment houses that lent to sugar planters and exporters in the Visayas for decades were closing theirs. At the crossroads of progress and depression, the bank endeavored to link the country’s sugar and key exports to the world market.

Soon after, the first foreign bank in the Philippines helped finance the construction of sugar and rice mills and the first provincial railway (the Manila-Dagupan Railway) in the 1880s. HSBC then opened its second branch in Iloilo — then the queen city of the South and the preferred port for global trade after Manila — in 1883.

Today, as it was in the past, the now HSBC Philippines is building more infrastructure initiatives. This time though, it channels its efforts towards seamless digital, sustainable and enterprise-wide technology engagements with its clients. In doing so, HSBC cements its reputation as one of the country’s leading full-service international banks.

Making “Asia’s Superstar”

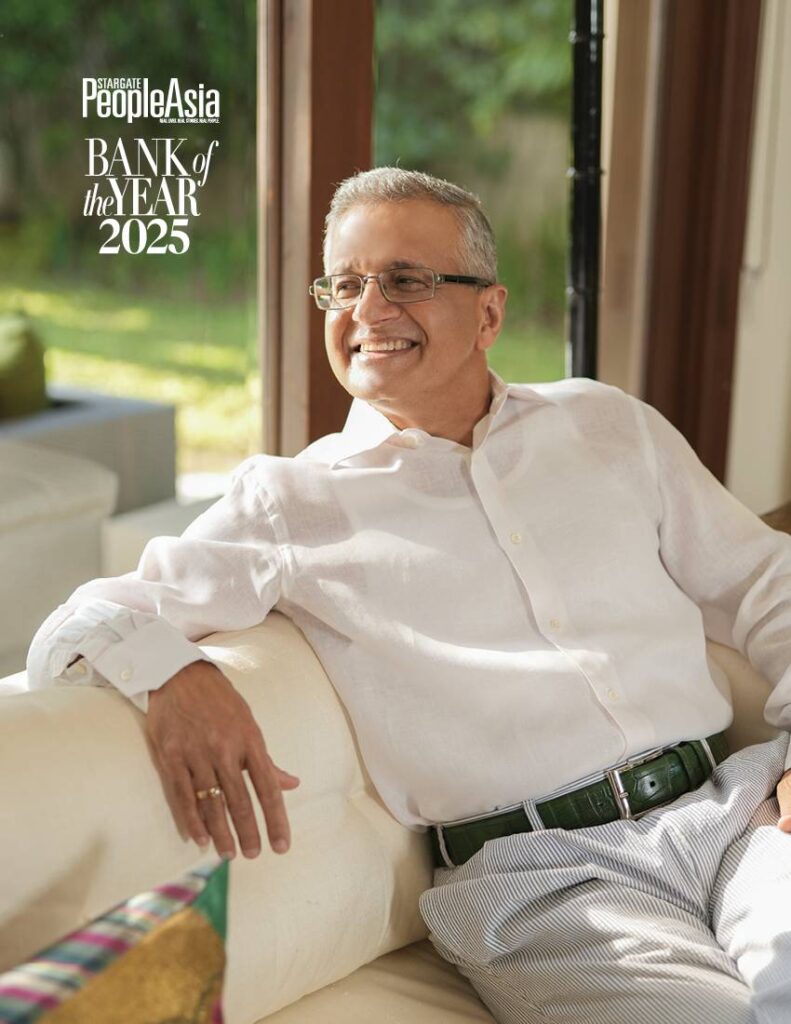

Under the steady hand of forward-looking president and CEO Sandeep Uppal, and with the support of six local branches and a global network spanning 60 countries, HSBC is driven by the same passion for excellence and innovations to realize its dream for the Philippine economy to become “Asia’s Superstar.”

“The Philippines is actually neck and neck with Malaysia in the second top spot in foreign direct investment (FDI) inflows, but it leads in the field of services FDI among Asia markets,” Uppal tells PeopleAsia.

He further explains that the country’s macroeconomic stability over the last two decades has made it an attractive FDI destination, especially for services. For its part, HSBC helps foreign investors “acclimatize” themselves in the Philippines and connect them with relevant partners.

Uppal adds that there is “a tremendous opportunity for the Philippines to continue on its path to growth,” noting that the multifold impact on its growth is possible if its good model on private and public partnership is taken to the next level.

“We can also emphasize to prospective investors the country’s three G’ — growing economy, growing population and growing trade liberalization — which could attract investments in anything linked to consumption and infrastructure development,” he says.

He cites HSBC Philippines itself as “a great example for the multinational corporation opportunity as we have prospered here since 1875.”

150 years

As HSBC gears up to celebrate its 150th year of operations in the Philippines on Nov. 29, 2025, Uppal acknowledges the continuous contributions of the bank to nation-building. These include partnerships with both government institutions and some of the country’s biggest conglomerates and companies.

“We continue to capitalize on our strength as an international bank by bridging our clients to opportunities within the Philippines and across the world, supporting their business expansion in Asia, Europe, Middle East and America,” Uppal explains.

For one, HSBC Philippines has partnered with the Philippine Economic Zone Authority (PEZA) to draw in foreign investments into the country. The bank’s leaders recently accompanied a PEZA delegation to key cities in India to explore opportunities in the pharmaceutical and information technology sectors that will benefit the country’s healthcare system and address unemployment.

The Philippine government also tapped HSBC Philippines to be one of the joint bookrunners in the issuance of its first Republic of the Philippines global bond that has raised $2billion. The proceeds will be used for general budget financing.

Meanwhile, its recent deals with private companies are set to improve infrastructure and further push economic growth.

These include being one of the joint bookrunners and lead managers for the return to the international bond market of SM Investments Corp., with its $ 500-million five-year bond that was 3.2 times oversubscribed, and the $ 350-million five-year bond of Vista Land & Lifescapes, Inc.

HSBC also partnered with PLDT through the provision of a P 1-billion green loan to fund the latter’s modernization and fiber network expansion and a P 2-billion social loan facility to expand the telecommunications firm’s fiber network in underserved areas.

“As we celebrate our 150th year in the Philippines, we will continue to work closely with the government and our clients in projects and activities that will spur economic growth,” assures Uppal.

A people’s business

Uppal believes that “banking is a people’s business.” He shares that HSBC Philippines has invested in developing its people, assuring clients that employees of the bank and the Philippine Global Service Center are well-equipped in skills and experience to e#ectively support their businesses or personal transactions.

Uppal beams with delight in sharing that “our local staff are recognized across the wider HSBC Group,” with many of its members either moving internationally or supporting its global franchise.

Filipinos believe in the same values and are strong performers like any HSBC team across the globe, but what sets the Philippine team apart is its passion and love for what they do.

“Filipinos are also known to be cheerful and always smiling, so working among teams is easy and fun, while all the tasks are getting done,” shares a proud Uppal.

Multi-awarded

With multiple awards for innovations tucked under its belt this year alone, HSBC Philippines has not let up in introducing banking solutions that are in step with the times, even while sustaining its retail and corporate banking services to its clients as a full-service international bank.

Uppal shares further that “we want HSBC Philippines to be known as not only the leading international bank, but also the most respected bank in the country. We have been here for almost 150 years, and we look forward to continuing supporting our customers well into the future,” says Uppal with high optimism.

The Bank, he assures, will stand ready to support its clients on their growth and expansion journeys, and provide them with “the right banking solutions to capture the opportunities in the region’s fast-growing digital economy.”

Its retail banking business carries on with client access to savings and time deposit accounts in up to 11 foreign currencies, loans, mortgages and credit cards.

HSBC Wealth, which provides a wide array of insurance and investment products to its Premier clients, has proven to be a successful model as it grew in wealth revenue and wealth assets under management since it was launched in 2022.

In July this year, HSBC Philippines introduced its Live+ Credit Card with up to eight percent cashback on dining and five percent cashback on shopping and entertainment.

HSBC Philippines will continue to adapt to the changing needs of its customers and provide them with digital banking solutions to ensure 24/7 service to its clients here and abroad.

In wholesale banking, HSBC Philippines offers business opportunities for its corporate clients across the bank’s extensive network. This helps them scale up using a full suite of tailored services that includes access to capital, easy cross-border transactions and advisory services, among others.

Offered in a number of currencies, including RMB, the Bank provides customized and innovative structured finance solutions to help businesses effectively manage and mitigate risks, improve cash flows and optimize trade operations. These include supply chain finance, receivables finance and export finance.

HSBC Philippines also launched Omni Collect in March 2024, which enables businesses to collect payments from customers digitally through such channels as online payments, electronic invoicing and direct debit, among others.

Joining the automated clearing house InstaPay, the real-time payments scheme under the National Retail Payments System of the Philippines, HSBC’s corporate clients can now send high-volume payments to their employees, suppliers, partners and customers in real time 24/7. This provides a powerful banking framework for HSBC Philippines clients when combined with its own market-leading online platform and international network.

Having spent three decades of his banking career with HSBC, how does Uppal see banks like HSBC Philippines prosper into the next century?

“Traditionally, banks were seen as a source of funding by business and thus largely worked with the “nance functions, but this is rapidly changing as banks are increasingly being seen as a provider of payment rails, which are often core to the operations of a business,” says Uppal.

Aligned with this trend, Uppal adds that HSBC has been investing on its payment infrastructure both locally and cross-border. “Towards this we are increasingly more mainstream for our customers with engagement being enterprise-wide beyond finance. Thus, over the coming decades, I do see HSBC to be that much more integrated into the operations of our customers and seen somewhat as an extension of their finance teams,” he ends.

Photography by MARK CHESTER ANG

Art direction by DEXTER FRANCIS DE VERA

Grooming by EDDIE MAR CABILTES